Table of Contents

ToggleHow to check my LIC Life Insurance policy status

How to Check Your Policy Status on LIC India’s Website

As a policyholder of the Life Insurance Corporation of India (LIC), keeping track of your policy status is crucial for effective financial planning and management. The official website of LIC (https://www.licindia.in) provides an accessible platform for customers to manage their policies, including checking the status of their insurance coverage. This guide will walk you through the step-by-step process of how to check your policy status on the LIC India website, along with some additional features the website offers.

My LIC Policy status helpline :

Now policyholder can easily check their Life Insurance policy status online by sending SMS also.

SMS LICHELP <pol.no.> to 9222492224 or SMS LICHELP <pol.no.> to 56767877.

Step 1: Accessing the LIC Website

Begin by navigating to the official LIC website at https://www.licindia.in. This site is designed to be user-friendly and provides a wealth of information about LIC’s products and services.

Step 2: Registering on the LIC Portal

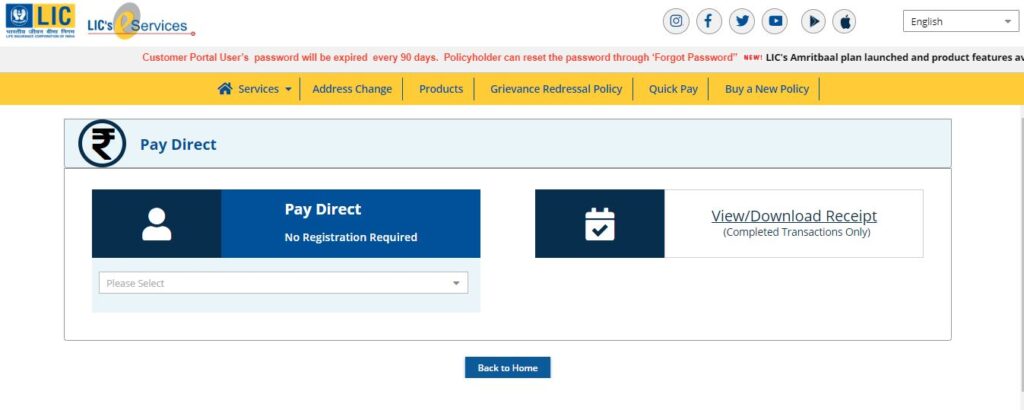

If this is your first time using the online services of LIC, you will need to register. Here’s how to do it:

- Click on the ‘Customer Portal’ link under the Online Services tab on the home page.

- Choose ‘New User’ from the options available.

- Fill in your details: You will be asked to provide your policy number, installment premium (without taxes), date of birth, email address, and mobile number. These details must match the records you provided when taking out the insurance.

- Create a User ID and Password: Once your information is validated, you can choose a User ID, password, and a hint question for future password recovery purposes.

- Complete Registration: Submit your registration form, and you will be given access to your digital customer account.

Step 3: Logging In to Check Policy Status

After registering, you can log in anytime to check your policy status:

- Return to the Customer Portal: Use the ‘Registered User’ link this time.

- Enter your User ID and Password: Once logged in, you will be directed to your profile dashboard.

Step 4: Viewing Your Policy Details

- Navigate to the Dashboard: Here, you’ll see an overview of all your policies listed.

- Select the Policy Number: Click on the specific policy number whose status you want to check.

- Check Policy Status: On the policy details page, you can see various details like next premium due, policy term, loan against policy, surrender value, and other relevant details.

LIC Life Insurance plans

Endowment Plans

| Money Back Plans

|

Whole Life Plans

| Term Assurance Plans

|

Step 5: Additional Features and Information

While logged in, you can also access various other services, such as:

- Premium Payment: Pay your premium online and view payment history.

- Loan Status: Check details to see if there’s a loan against the policy.

- Claim Status: Check the status of any claim filed.

- Grievance Status: Track any complaints or issues you have raised.

Step 6: Managing Your Account

You can update personal information, change your password, and manage your contact details through the profile management feature in your account.

Step 7: Logging Out

Always ensure to log out of your account after checking your policy to secure your personal information.

Additional Tips and Information

- Privacy and Security: Ensure that your computer or device is secure while accessing your LIC account. Avoid using public or unsecured Wi-Fi networks.

- Keeping Track of Your Details: Regularly update your contact details on the portal to receive timely updates and information from LIC.

- Digital Document Facility: You can also view and download a digital version of your policy document from the portal.

- Mobile Apps: For easier access, consider downloading the LIC app available on both Android and iOS platforms, which allows you to manage your policies on the go.

LIC’s online portal provides a convenient and efficient way for policyholders to manage their insurance policies. By following the steps outlined above, you can easily check your policy status and utilize various other services offered by LIC. Regularly checking your policy status not only helps in keeping updated with your financial planning but also ensures that you are aware of all benefits, dues, and facilities associated with your LIC policy. With digital access, managing your life insurance policy is now at your fingertips, providing a seamless and hassle-free insurance experience.

LIC of India plans like endowment, money back, pension, senior citizen, term plans, ULIP, NRI and One-time Investment plans are very popular in the market. Most of the regular plans are sold by LIC Agents only. One-time investment plans are available online for clients.