Table of Contents

ToggleLIC New policy buy for guaranteed returns

Life Insurance Corporation of India (LIC) has been the cornerstone of insurance for millions of Indians, offering a wide range of policies that cater to different life stages and financial needs. As we step into 2024, LIC has introduced new policies and refined existing ones to provide more comprehensive coverage and benefits. This guide will cover key policies including life insurance, child education, money-back every five years, fixed income monthly plans, guaranteed lifetime pension, senior citizen monthly income, and the best claim settlement term plans. For more information or to purchase any LIC policy from anywhere in India.

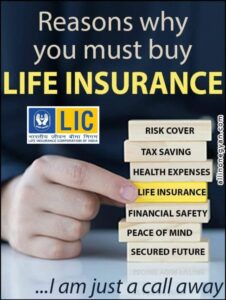

1. Life Insurance Policies

Life insurance is a fundamental aspect of financial planning, providing financial security to your loved ones in the event of your untimely demise. LIC’s new life insurance policies for 2024 offer enhanced features:

- Jeevan Amar: This term insurance plan offers high coverage at low premiums. It provides flexibility in choosing the sum assured, ensuring that your family’s financial needs are met even in your absence.

- Jeevan Labh: A limited premium-paying, non-linked, with-profits endowment plan that provides a combination of protection and savings. It is ideal for those who want to ensure their family’s financial security while also saving for future needs.

- LIC Jeevan Umang: LIC Jeevan Umang is a versatile life insurance plan offering annual survival benefits from the end of the premium paying term until maturity and a lump sum payout at maturity or on the policyholder’s death. It provides lifelong coverage up to 100 years of age. The plan also offers tax-free yearly returns under Section 10(10D) of the Income Tax Act, making it an excellent option for those seeking long-term financial security with the added advantage of tax benefits. For more details or to purchase LIC Jeevan Umang, visit https://www.licindia.in

2. Child Education Plans

Ensuring the best education for children is a priority for every parent. LIC’s child education plans help parents save systematically to fund their child’s education:

- LIC New Children’s Money Back Plan: This policy offers periodic payouts to meet the educational milestones of your child. It provides survival benefits at the end of the 5th, 10th, and 15th year, and a lump sum at maturity, ensuring that educational expenses are taken care of without financial strain.

- Jeevan Tarun: Designed specifically for children’s education and marriage, this plan offers flexible payouts during crucial educational phases, with an option to receive annual payouts starting from the child’s 20th birthday till they turn 25.

3. Money-Back Plans

LIC’s money-back policies are designed to provide periodic payments, ensuring liquidity at regular intervals:

- Bima Shree: A limited premium paying money back plan that offers payouts during the policy term. It combines insurance coverage with regular returns, making it ideal for those looking for periodic income and long-term savings.

- New Money Back Plan—20 Years: This plan provides survival benefits every five years, making it suitable for individuals seeking regular returns. At the end of the policy term, the maturity benefit, along with bonuses, is paid out.

4. Guaranteed lifetime fixed monthly income plans

Retirement planning is crucial to ensuring a financially secure and stress-free life post-retirement. LIC’s pension plans offer guaranteed income for life:For those looking for a steady income stream, LIC’s fixed income monthly plans are ideal:

- LIC Jeevan Shanti: A single premium deferred annuity plan that offers guaranteed monthly, quarterly, half-yearly or yearly fixed income for a lifetime. A flexible pension plan offering both immediate and deferred annuity options. It provides guaranteed returns with an option to choose single or joint life policies, ensuring lifetime income for policyholders and their spouses.

- Jeevan Akshay VII: A single premium immediate annuity plan that offers multiple annuity options, including a fixed income for life, ensuring a regular stream of income post-retirement.

5. Best Claim Settlement Term Plan

LIC has a reputation for having one of the best claim settlement ratios in the industry. Here are some of the standout term plans with excellent claim settlement records:

- LIC Jeevan Amar: A pure offline term insurance plan. LIC Jeevan Amar is a term insurance plan offering substantial coverage at affordable premiums. This non-linked, non-participating plan provides financial protection to the insured’s family in case of the policyholder’s demise during the policy term. Key features include flexible policy terms, choice of single or regular premium payments, and options for increasing coverage through riders. Additionally, the plan offers tax benefits under Section 80C and 10(10D) of the Income Tax Act, making it a cost-effective solution for comprehensive life insurance coverage.

- Tech Term: A non-linked, non-participating online term insurance plan that offers an additional option to increase coverage through riders. It is known for its hassle-free claim settlement process, ensuring quick and efficient service to policyholders’ families. This is an online term policy offering high sum assured at low premiums. The plan is designed to cover the financial risk of the policyholder’s death, providing a substantial sum to the family.

Example:

Let’s consider an example to understand how these policies can be integrated to secure a comprehensive financial plan.

Profile:

- Age: 35

- Profession: IT Professional

- Family: Spouse (Age: 32), Child (Age: 5)

- The below-given calculations may change as per the entry age and term of the policy.

Insurance Portfolio:

- Life Insurance: Jeevan Amar

- Sum Assured: ₹1 crore

- Premium: ₹39500 annually

- Benefit: Financial security for family in case of untimely demise.

- Child Education: LIC New Children’s Money Back Plan

- Sum Assured: ₹10 lakh

- Premium: ₹50,000 annually

- Benefit: Periodic payouts at age 10, 15, and 20 of the child, with a lump sum at maturity.

- Money Back Plan: Bima Shree

- Sum Assured: ₹10 lakh

- Premium: ₹60,000 annually

- Benefit: Payouts every 5 years, ensuring liquidity and meeting medium-term financial goals.

- Fixed Income Plan: Jeevan Akshay VII

- Purchase Price: ₹50 lakh

- Monthly Pension: ₹27542/- or 3,42,500/-

- Benefit: steady income stream post-retirement.

- Guaranteed Pension: Jeevan Shanti

- Purchase Price: ₹10 lakh

- Deferred Annuity: Starts at age 60, providing₹37000/- monthly.

- Benefit: lifetime income post-retirement.

LIC’s policies provide comprehensive solutions for various financial needs, from ensuring life insurance coverage to securing child education, providing periodic money backs, ensuring fixed monthly income, and guaranteeing lifetime pensions. These policies are tailored to fit different life stages and financial goals, ensuring peace of mind and financial security.

LIC policies can be purchased using various payment methods, including UPI, credit card, net banking, and debit card, making the process convenient and accessible from anywhere in India.