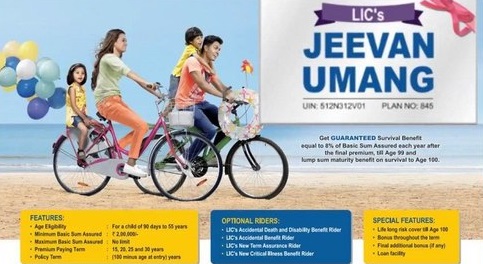

LIC JEEVAN UMANG Plan 945

LIC’s Jeevan Umang plan offers a combination of income and protection to your family. This plan provides for annual survival benefits from the end of the premium paying term till maturity and a lump sum payment at the time of maturity or on the death of the policyholder during the policy term.

LIC JEEVAN UMANG Plan 945 plan benefits

On Death: Sum Assured on Death + Simple Reversionary Bonuses till the term of death + Final Additional Bonus shall be payable.

Survival Benefit: This benefit is payable from the end of the premium paying term as decided by the policyholder from the 16th, 20th, 25th, or 30th year.

After the completion of the premium paying term, 8% of the Sum Assured, is payable on completion of each subsequent year till the Life assured survives or till maturity.

On Maturity: Sum Assured + Simple Reversionary Bonuses + Final Additional Bonus shall be payable.

OPTIONAL BENEFITS in LIC Jeevan Umang Plan 945 (Riders)

Accidental Benefit Rider: On Death double, the Sum Assured shall be payable.

The benefit covered under this plan is up to the age of Life Assured is 70 Years or till PPT, whichever is earlier.

Accidental Death and Disability Benefit: On Death double, the Sum Assured shall be payable.

Except for the Premium waiver benefit, all other riders are allowed only for those aged 18 years and above.

Term Assurance Rider: Provides Life Cover in case of Death. Allowed only for those aged 18 years and above.

The additional premium for the term rider is paid along with the premium of the basic plan.

Premium Waiver Rider: In case of the death of the Proposer, the payment of the premium falling due after the date of death shall be waived.

Critical Illness Rider: On the first diagnosis of any one of the 15 Critical Illnesses covered under this rider, the Critical Sum Assured shall be payable. Nothing will be payable on Death and Maturity.

ELIGIBILITY CONDITIONS

The minimum age to get the maturity benefit should be 30 years completed.

Minimum Sum Assured: Rs. 2,00,000/-

Maximum SUM ASSURED: No-Limit

MODE OF PREMIUM: Yearly, Half Yearly, Quarterly, Monthly

SURRENDER VALUE UNDER LIC JEEVAN UMANG PLAN

The policy can be surrendered at any time during the policy term, provided at least two full years of premium have been paid.

LOAN

At least two full years of premium payment to apply for the loan facility.

The rate of interest on the loan is 9.5% per annum (as of 31/12/2023 ).

INCOME TAX BENEFITS

All premiums paid to LIC Jeevan Umang plan can be claimed under section 80C of the Income Tax Act provided it comes under the maximum ceiling of Rs. 1,50,000/-.

All payments from LIC of India like survival benefits, maturity, or any claim are 100% TAX-free under section 10 (10 D ) of the Income Tax Act.

LIC Jeevan Umang plan 945 – features and policy benefits – Buy LIC New policy